All Categories

Featured

[/image][=video]

[/video]

Let's say you have a hundred thousand dollars in a financial institution, and afterwards you find it a financial investment, a syndication or something that you're intending to place a hundred thousand into. Now it's gone from the bank and it remains in the syndication. It's either in the bank or the syndication, one of the two, however it's not in both.

And I attempt to assist individuals understand, you recognize, how to enhance that efficiency of their, their money so that they can do even more with it. And I'm really going to attempt to make this simple of utilizing an asset to buy another possession.

Investor do this regularly, where you would certainly develop equity in a genuine estate or a residential or commercial property that you have, any, any kind of genuine estate. And afterwards you would take an equity position against that and use it to acquire one more home. You recognize, that that's not an an international concept whatsoever, correct? Absolutely.

And afterwards using that actual estate to buy more real estate is that then you become very revealed to realty, suggesting that it's all associated. Every one of those assets end up being associated. So in a slump, in the totality of the property market, then when those, you know, points begin to decline, which does occur.

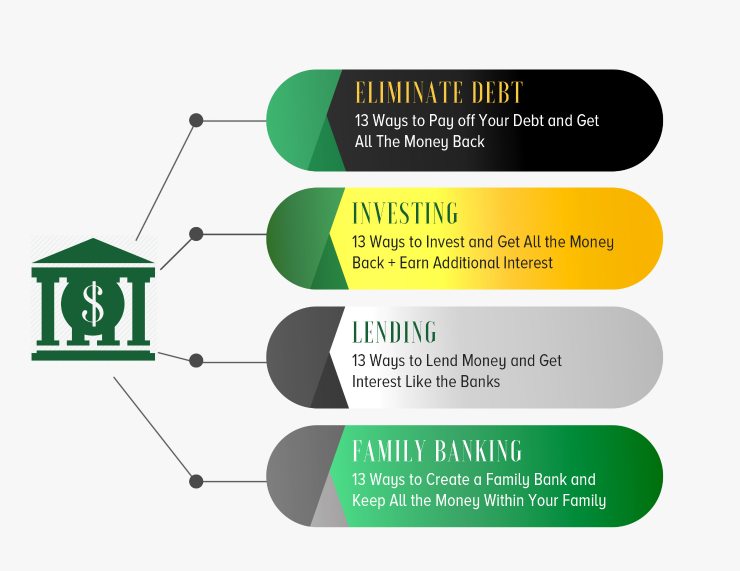

Uh, you know, and so you don't want to have all of your possessions associated. What this does is it gives you a location to put cash originally that is totally uncorrelated to the real estate market that is going to be there guaranteed and be ensured to enhance in value over time that you can still have a very high collateralization variable or like a hundred percent collateralization of the cash money worth inside of these plans.

Universal Bank Unlimited Check

I'm trying to make that as straightforward as feasible. Does that make sense to you Marco?

So if they had a home worth a million bucks, that they had actually $500,000 paid off on, they could possibly obtain a $300,000 home equity credit line because they typically would obtain an 80 20 lending to worth on that. And they can get a $300,000 home equity line of credit history.

Cash Flow Whole Life Insurance

For one thing, that credit rating line is dealt with. In other words, it's going to continue to be at $300,000, no matter how long it goes, it's going to stay at 300,000, unless you go obtain a brand-new appraisal and you get requalified monetarily, and you raise your debt line, which is a big pain to do every time you put in money, which is commonly as soon as a year, you add brand-new capital to one of these particularly created bulletproof riches policies that I create for people, your inner line of credit score or your accessibility to capital goes up every year.

Latest Posts

Hybrid Debt & Mortgage Arbitrage, Become Your Own Bank

How To Become Your Own Bank

Be Your Own Bank Life Insurance